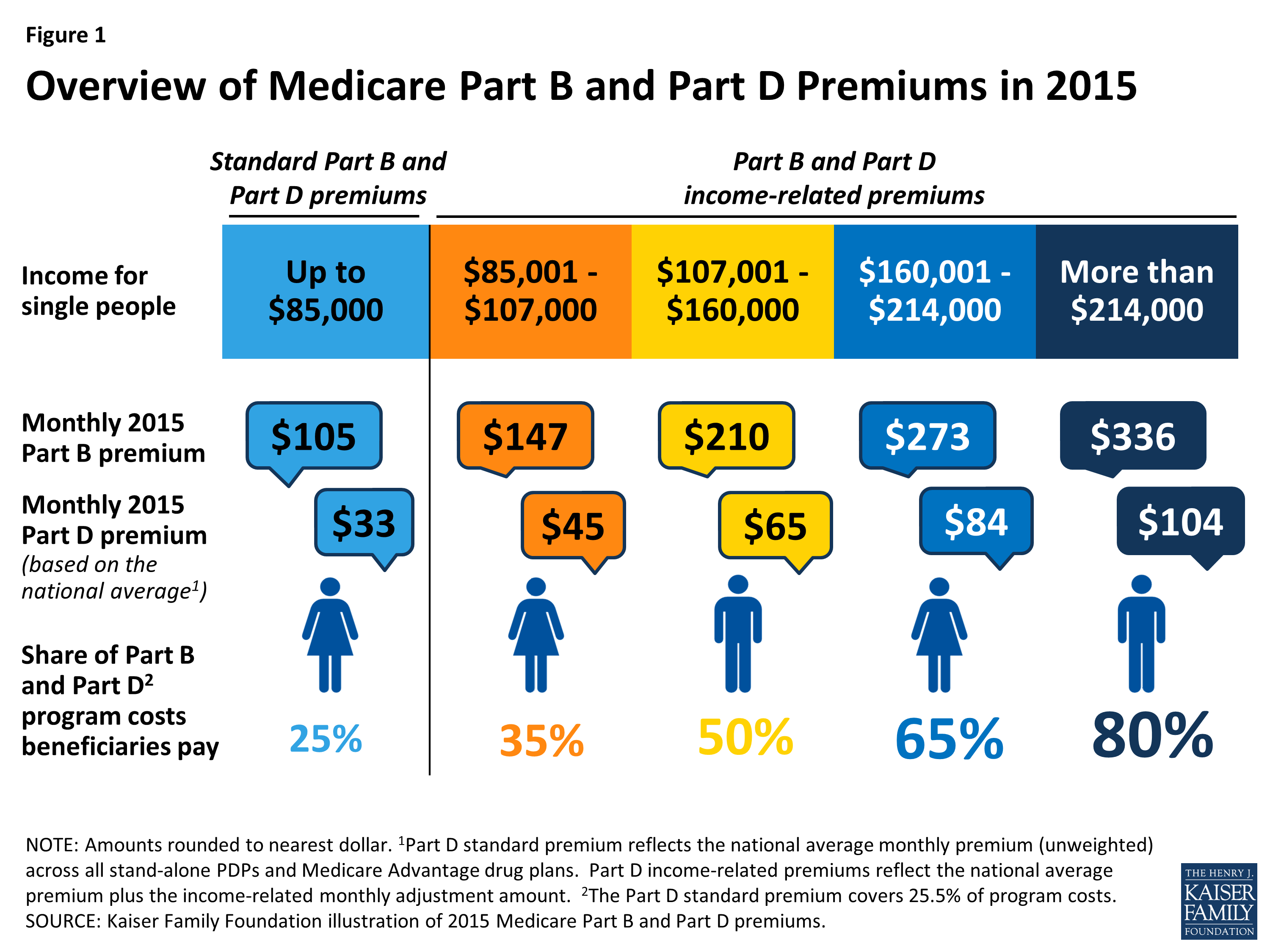

There are a few key takeaways that one needs to know to put explanations of Medicare Supplement programs (Medigap) and Medicare Advantage plans into context. The doughnut hole left Medicare Part D patients paying a higher rate for drugs for a few thousand dollars’ worths of annual purchases for several years. Part D coverage has a coverage gap known as a ‘doughnut hole’.This coverage gap is scheduled to close by 2020.Offers catastrophic coverage for very high costs drugs.It is an optional service offered by private sector organizations. (These plans are discussed in greater detail in this article.) Part DĬovers prescription drugs. These programs often include Part D benefits and may also offer ancillary medical services, such as dental or vision care, not covered under Medicare. These are private insurance programs, typically run on an HMO or PPO basis, that offers Medicare-like services. If a person is working and covered under a company medical plan, it is critical to speak with HR about possible conflicts with Part B benefits.Annual wellness visit and some preventive services require no payment by the insured.Requires co-pays on most Part B services.Requires a monthly insurance premium ranging from $134 (2018) for individuals earning $85,000 or less increasing to $428.60 (2018) for individuals earning $170,000 or more.

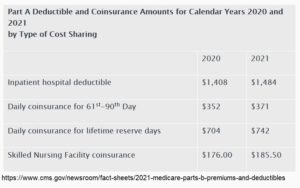

Part B benefits are subject to a deductible ($183 in 2018).If you sign up within the 3-month period following your 65th birthday, you may have a six-month delay in starting.Ĭovers physician visits, outpatient services, preventive services, durable medical equipment, and some home health services. People may sign up beginning 3 months before their 65th birthday.Co-pays are required for extended stays.Part A benefits are subject to a deductible ($1,340 in 2018).People with qualifying work histories pay nothing for Part A coverage.Part AĬovers hospital bills when a person is in a hospital or skilled nursing facility. The basic Medicare program consists of 4 parts, labeled A through D. That is, an explanation of parts A, B, C and D that make up Medicare. In this article I will walk you though the “ABCD” of Medicare plans. Roughly 60 million people are insured under Medicare. Like most government programs, it has grown and become far more expensive than ever envisioned. It has become a very popular program with seniors and insurance companies. *For additional Medicare information visit Medicare.Medicare was launched in 1965 to provide health insurance coverage for America’s seniors.

They can also have rules about where you get services, such as needing referrals or prior authorizations for treatment.Ĭontact me for help selecting the best Medicare plan for you. Each Medicare Advantage plan can charge different out-of-pocket costs. Medicare Advantage, which is a bundled plan that includes Part A, Part B, and Part D coverage. You have a deductible along with a 20% coinsurance, but if you add a Medicare Supplement, those costs are typically covered. Original Medicare, which includes Part A and Part B. Once you enroll, you’ll need to decide how you’ll get your Medicare coverage. With Medicare, you have options in how you get your coverage.

Part D is Prescription Drug Coverage and helps cover the cost of prescription drugs, including shots and vaccines. Medicare Advantage is funded by the federal government but offered by private insurance carriers. Part C, or Medicare Advantage, is an all-in-one alternative to Original Medicare. Part B is Medical Insurance and covers physician services, outpatient care, tests and supplies. Part A is Hospital Insurance and covers costs associated with confinement in a hospital or skilled nursing facility.

0 kommentar(er)

0 kommentar(er)